Posted on: Tuesday, December 10, 2024

As we wrap up what has been a strong year for the housing market, it has fared better than expected with inflation under control and the bank rate on a downward trend. The improving outlook has provided increased certainty for buyers, resulting in a rebound in market activity and a return to price growth.

Starting the year at 4.0%, CPI inflation has steadily decreased toward its 2.0% target, and while it was higher than expected at 2.3% in October, it is forecast to remain close to the target in 2025 (ONS). The Bank of England reduced interest rates to 4.75% in November, down from 5%, a welcome optimism boost for the housing market, with consensus forecasts projecting a drop to 4% or lower by the end of 2025*. Approximately 640,000 mortgage holders on tracker rates will feel an immediate boost to their finances, and an additional 770,000 on standard variable rates should receive at least some of the cut.

*HM Treasury, Average of Independent Forecasts November 2024

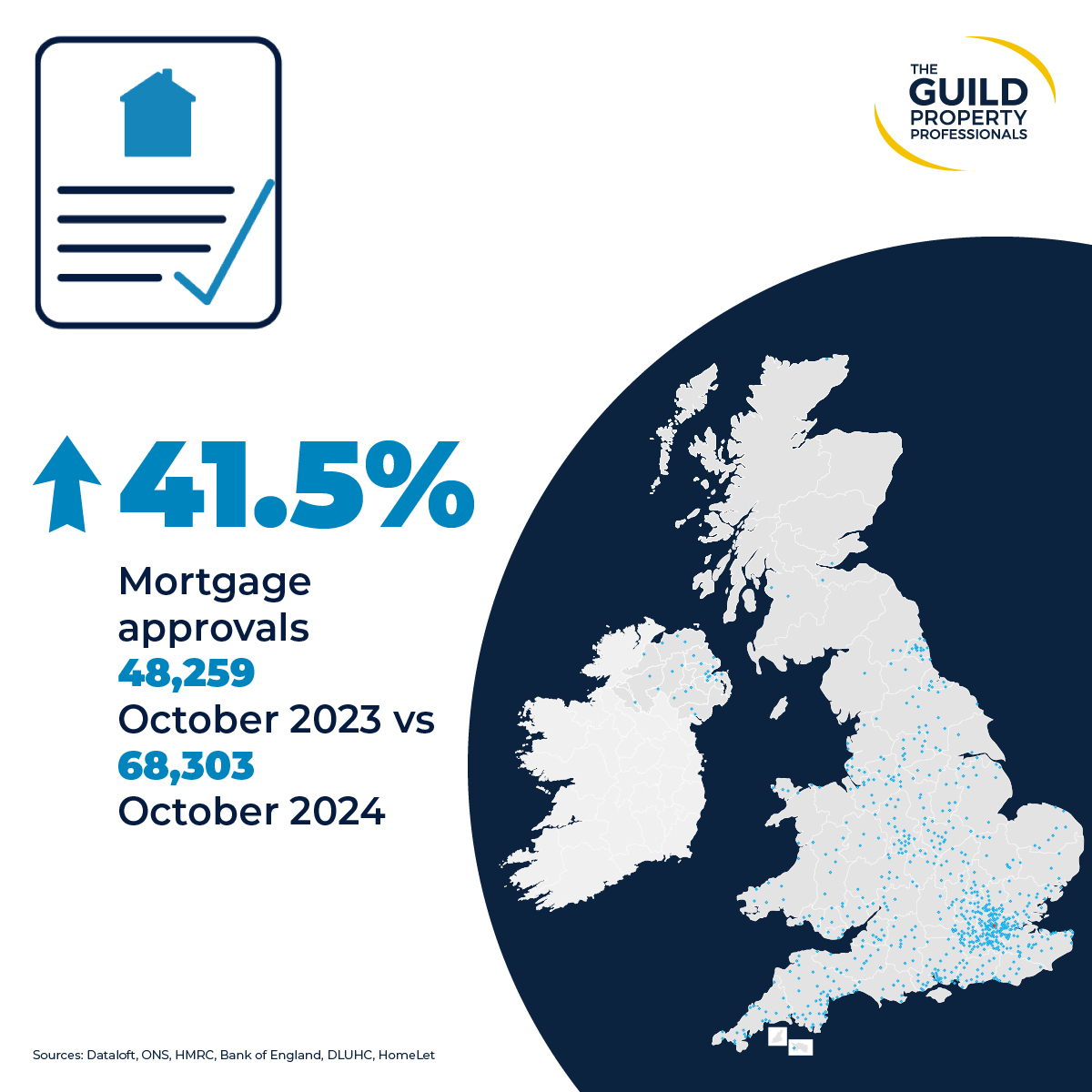

Even though the latest cut did not flow through to fixed mortgage rates, it gave a further boost to sentiment and rates are still lower than a year ago. The average two- and five-year fixed-rate mortgages are currently at 5.08% and 4.85% respectively, showing a year-on-year decrease of -0.47% and -0.28%*. The next Bank Rate cut should further boost optimism amongst movers and help to improve affordability through 2025. Mortgage approvals in October reached 68,303, the highest level since August 2022, as market activity builds. This marks a 42% year-on-year increase and a 3% rise compared to October 2019 (Bank of England).

*Podium, 26 November 2024

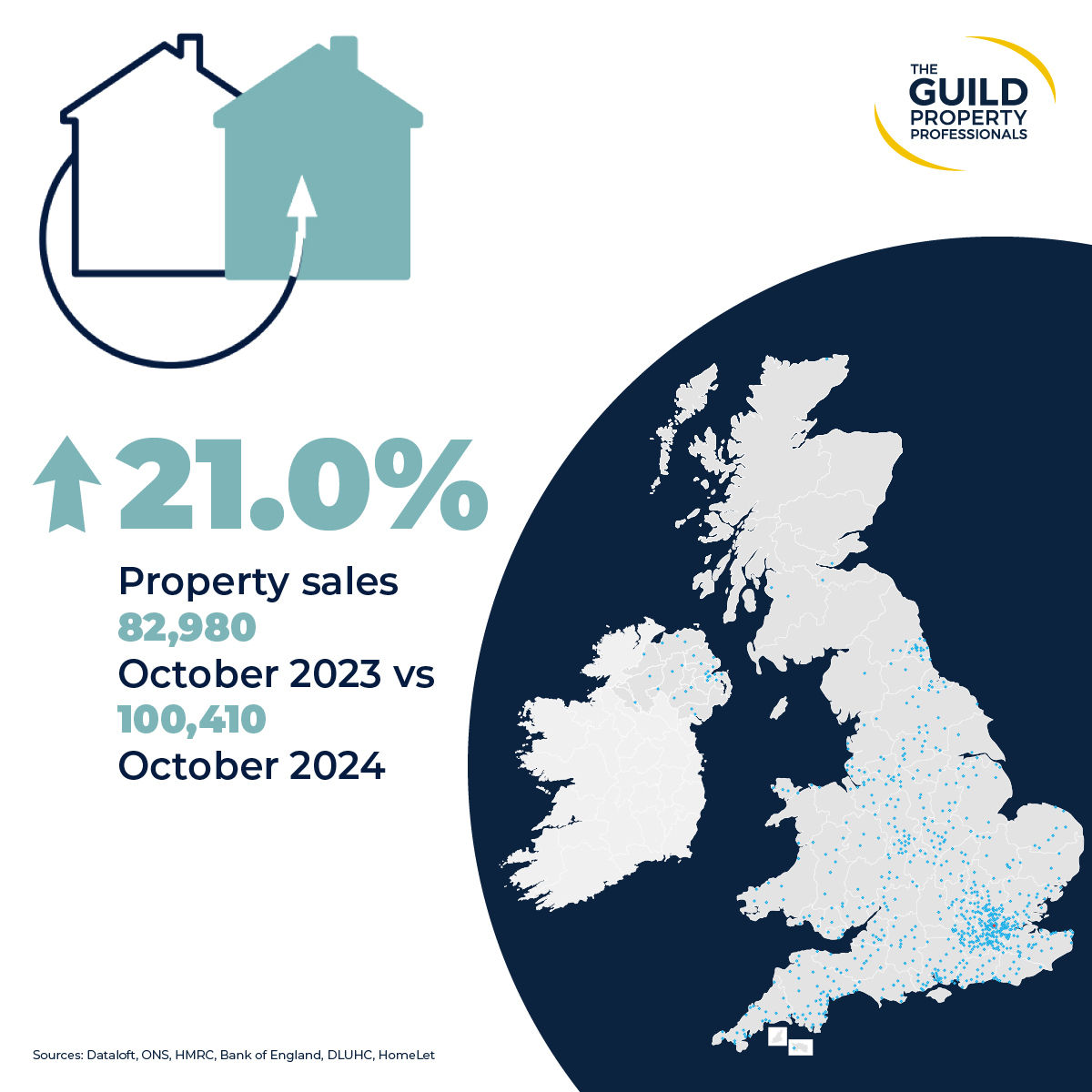

Transaction activity continues to build, with 100,410 transactions in October, the highest level since November 2022 (HMRC). In the autumn Budget it was confirmed that stamp duty thresholds in England would return to previous levels from 1st April 2025, meaning the exemption limit for first time buyers drops from £425,000 to £300,000. That will mean only around 8% of the homes for sale in London would be stamp-duty free for first-time buyers, 24% in the South East and 32% in the East of England. Rightmove data shows an uptick in first-time buyer demand in higher-priced areas of the country, as they rush to beat the April deadline.

Following the last couple of years of rapid rental growth, the rate of growth is slowing. In October, the average rent was £1,327, a 3.4% year-on-year increase, marking the lowest growth rate since April 2021 (HomeLet). Rental growth is expected to return to its long-term trend after a period of unsustainably high rates of growth. The consensus forecast predicts 3.7% rental growth in 2025 and 3.3% in 2026*.

The government has confirmed that all homes in the private rented sector will have to achieve Energy Performance Certificate 'C' or equivalent by 2030. However, two thirds (67%) of investors currently own at least one property that does not meet the new requirements**.

*Savills, Knight Frank, JLL, CBRE, November 2024, Dataloft by PriceHubble

**Foundation Home Loans Q3 2024

Browse our Regional Market Reports:

Winter 2024: Southern Home Counties

Winter 2024: North East, Yorkshire and the Humber

Winter 2024: Essex, Norfolk and Suffolk

Winter 2024: Herts, Beds and Cambridgeshire

Winter 2024: Devon and Cornwall

Winter 2024: Thames Valley, Berkshire, Oxfordshire, Buckinghamshire

Winter 2024: South East Home Counties, Kent and East Sussex

Winter 2024: Southern - Isle of Wight, Dorset, Hampshire, Wiltshire

Sell your property with your local expert this winter. Contact your local Guild Member today.

We are required by law to conduct anti-money laundering checks on all those selling or buying a property. Whilst we retain responsibility for ensuring checks and any ongoing monitoring are carried out correctly, the initial checks are carried out on our behalf by Lifetime Legal who will contact you once you have agreed to instruct us in your sale or had an offer accepted on a property you wish to buy. The cost of these checks is £60 (incl. VAT), which covers the cost of obtaining relevant data and any manual checks and monitoring which might be required. This fee will need to be paid by you in advance of us publishing your property (in the case of a vendor) or issuing a memorandum of sale (in the case of a buyer), directly to Lifetime Legal, and is non-refundable. We will receive some of the fee taken by Lifetime Legal to compensate for its role in the provision of these checks.